Permanent Account Number

Permanent Account Number (PAN) is a unique number allotted by the Income Tax Department of India. Non-Resident Indians (NRI), Foreign Nationals, & Foreign Companies - they all may need PAN Number. PAN Card is available in the digital format and also a laminated tamper-proof card.

Why do I need a PAN Card?

Individuals and companies must quote their Permanent Account Number (PAN) along with any payments due to Income Tax Department. They must also PAN number on most financial transactions - fixed deposits, property purchase, investing in stocks/shares, mutual funds, start a new business, etc.

What is e-PAN and will it be accepted?

e-PAN is a digitally signed PAN card issued in electronic format by the Income-tax department of India. Yes, e-PAN is a valid proof of PAN.

Can I receive a PAN Card outside India?

Yes. Once the application is successfully processed, the applicant will receive (1) e-PAN by E-mail and (2) Physical PAN Card at the overseas address.

Difference between NRI PAN Card and normal PAN Card?

For NRI / OCI / Foreign Citizens, the application form must carry International Taxation AO Codes. Pan Card Express will help you with the correct International Taxation AO Code.

How significant is the Communication address that I provide on application?

Indian Income Tax Department sends official communication to the address mentioned on the application form. PAN Card is delivered only to the address on the proof document. So to avoid any inconveniences in the future, please ensure that your communication address is up-to-date in the database of the Income Tax Department of India.

What is the processing time of PAN Application?

After the applicant completes an online application form and pays the fees, the following are subsequent steps:

- Step 1: For the preliminary validation, applicants may send supporting documents by email with proof of ID and proof of address. This step will help to avoid rework later – if any errors in the application form.

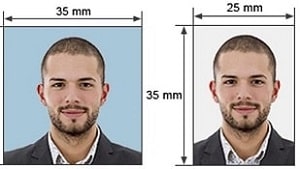

- Step 2: Once proof documents are reviewed, the applicant will be requested to print the application form, paste photo, sign, and send paperwork to Chennai (India).

- Step 3: The applicant shall receive an automatic e-mail with acknowledgment number / coupon number to track PAN Status online.

- Step 4: For most applicants, PAN Number is allotted and available online in 5 to 7 working days (indicative). Within two days of allotment, the applicant will receive ePAN card by E-mail.

- Step 5: Physical PAN Card will be printed in plastic and dispatched by registered post/courier. This step takes about another two weeks after allotment.

Who will process the applications?

Applicants who require international support and are time-sensitive, make use of services from PAN Card Express. PAN Services Units from the Income Tax Department of India will process all the applications through UTI ITSL / NSDL.

Are NRI, OCI, and Foreign Citizens eligible to get Aadhaar?

Aadhaar is not mandatory for PAN when the applicant resides outside India. Visit UIDAI Portal to learn about Aadhaar eligibility.

How to find PAN Number using my name and address?

PAN Number is confidential. Contact Income Tax Department of India if PAN Number is not available.

Can a person or business have more than one PAN Number?

No. A person or business is allowed to have only one PAN Number.

How to update address?

Apply

here to update current address and also reprint a duplicate PAN Card.

Lost PAN Card. How to request a duplicate?

Apply for a reprint by quoting the PAN Number of the lost card.

During reprint of lost/damaged PAN Card, Can I also request to update address/photo/e-mail?

Yes. Together in one application form - applicant may request to print a duplicate PAN Card and also ask for an address update.

A person obtained PAN Number as Indian Citizen, but now changed citizenship. Need to apply for another new PAN Number?

No. Do not apply for a new PAN Number. The individual must use the same PAN Number allotted at the first time.

Apply for a reprint of a duplicate card quoting the same PAN Number. Even if citizenship is changed, the PAN Number remains the same.

What is the QR code found on PAN Card?

QR code on PAN Card contains demographic details of applicant - name, date of birth and photograph.

PAN Format?

Permanent Account Number would look like ABCPL

nnnnS. Total of 10 characters/digits with below logic:

- The first three characters i.e. "ABC" in the above PAN, are alphabetic series running from AAA to ZZZ.

- The fourth character i.e., "P," stands for the Individual status of the applicant.

- Fifth character i.e., "L" in the above PAN, represents the first character of the PAN holder's last name/surname.

- The next four characters, i.e., "nnnn" in the PAN format, are sequential numbers running from 0001 to 9999.

- Last character i.e., "S" in the PAN format, is an alphabetic check digit.